Individuals’ personal information should be protected from fraudsters when purchasing a product or service online. There are usually a lot of payment options when purchasing a product or service. In particular, when buying online, your customers’ data must remain protected and safe. Your client’s credit card information must be protected and sent to you in encrypted form to prevent fraud. A payment gateway allows you to receive encrypted credit card information from your customers without having to invest in additional technology or services.

Payment gateway – What is it?

Customers buying goods or services must pay for them using their preferred payment method. Credit or debit cards are frequently used. A payment gateway serves as a middleman between buyer and seller, collecting and processing the necessary payment information. A payment portal is required to process and encrypt payment information from your customers. At the same time, it guarantees credit card data protection. It is required for both online payments and payments through a mobile device.

What is the need for it?

Even though shopping online may be safer than purchasing at a local store, payment gateways are still essential. A payment gateway allows the buyer to enter credit card information online similar to swiping a card on a payment machine, in the offline world. . Because verifying that the buyer owns the card is difficult, a payment gateway can help. It securely transmits the buyer’s private data to the retailer. The data is encrypted to prevent criminals from accessing the buyer’s sensitive data. The payment will not be processed if the buyer’s account does not have sufficient funds.

Costs of setting up payment gateway

The charges are typically based on the provider and vary based on the size of the merchant and the number of transactions. Typical fees charged for using a payment gateway include transaction fees, setup fees, and regular maintenance costs.

How does it work?

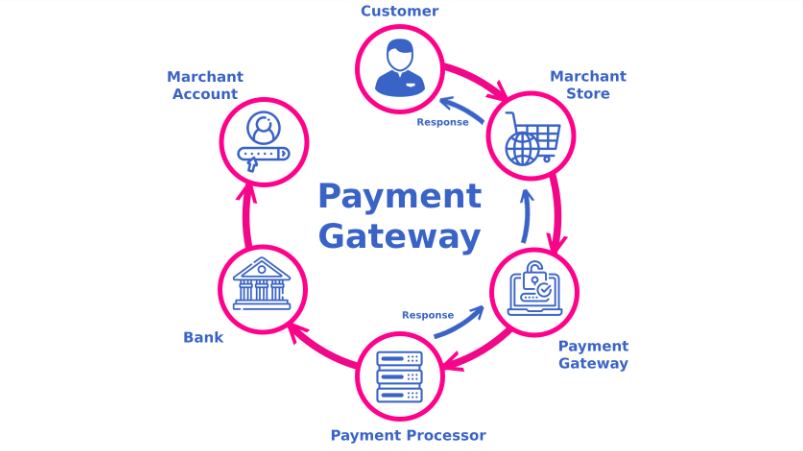

Although the payment gateway handles sensitive customer information and ensures secure transactions, the customer must first select a product or service. The payment gateway requires a customer to select a product or service and choose a payment option. Customers must enter their card information on the checkout page. There are certain standards. When you send the encrypted data to the appropriate card system, it is rechecked for fraud or abuse. Once the data is verified, it is forwarded to the customer’s issuing bank. There, payment is checked and approved. If payment is rejected, the customer is notified immediately. When a payment is made, the payment gateway informs the dealer whether the payment was accepted or rejected. The dealer then collects the outstanding amount from the customer’s bank account.

What to consider before going for it?

Your decision should be well thought out, and consider several things before choosing a payment gateway.

- The ordering process should be seamless and secure after integrating a payment gateway. It should be straightforward for the customer to purchase. If the purchasing process is difficult or takes too long, the customer might opt for a different online store.

- Your customers should be able to pay with their preferred credit or debit card through your payment gateway.

- Because shopping is frequently done on mobile phones nowadays, the ordering process must also run smoothly on mobile devices.

- It is imperative to consider data security as a key aspect of payment gateway selection. Regardless of the situation, the payment gateway must safeguard confidential customer data and keep it safe.

- The payment gateway must be easy to integrate into your website. Compatibility is significant here.

- Global reach is possible with online stores. However, if you also want to reach people worldwide, you should pick a payment gateway that accepts global payments.

- Moreover, it is crucial to becoming knowledgeable about the fee structure. The price for a payment gateway depends on the provider, which must be considered when making your decision.

Summary: We know that when it comes to developing eCommerce applications, picking the right payment gateway remains a daunting task. It can be difficult to decide on a single aggregator, given the number of options available. That’s why the Nimbbl payment gateway is suggested for merchants. It’s a smarter way of making payments through any eCommerce website using any major payment gateway. You can use Nimbbl to build an online store and integrate payments seamlessly with any existing website or mobile app. Use the Nimbbl dashboard to integrate your online store with any payment gateway without tech skills or operations. With Nimbbl, you can build eCommerce businesses capable of handling a high volume of transactions.